Value vs Absorption – how to price?

Value vs Absorption, a great article written by one of our experts, Peter Bryans.

There are so many pricing theories, strategies, approaches and so on throughout textbooks and the internet. To distil what is simple from what can be overly convoluted and complex – there are only two ways to set a price:

- Value Pricing; or

- Absorption Pricing

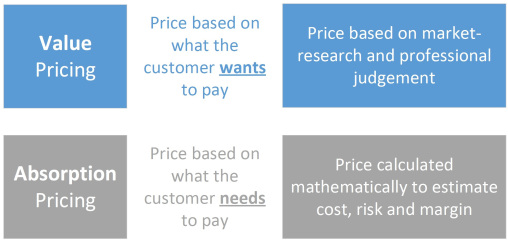

Value pricing is linked to the principles of what your customers are prepared to pay, Absorption is linked to the principles of mathematics on recovering the costs to meet your customer’s demand whilst making a profit.

Quite simply value pricing is predicated on what the customer wants to pay (or is believed to want to pay) whilst absorption is what the customer needs to pay so that costs are recovered and the supplier makes money.

Excluding luxury goods, does your customer ever want to pay more than you need them to?

To secure a sale, value pricing will be preferred on the viewpoint that work can only be won if the competition is beaten. On this basis, the price ‘is what it is’ and it is for the business to reverse-engineer profit, risk mitigation, cost recovery and a solution to fit within the set-price. The problem comes when price is too low for a business to work within or if milestone payments govern when and how much is paid; this can lead to problems with cashflow if you are spending money, to service a customer, at a rate greater than you are being paid over time.

To maximise the chances of being able to deliver to time, cost and quality and to yield a profit from a customer Absorption pricing will be preferred. The main problem can be that the calculated price is well above the competition.

Pro’s and Con’s

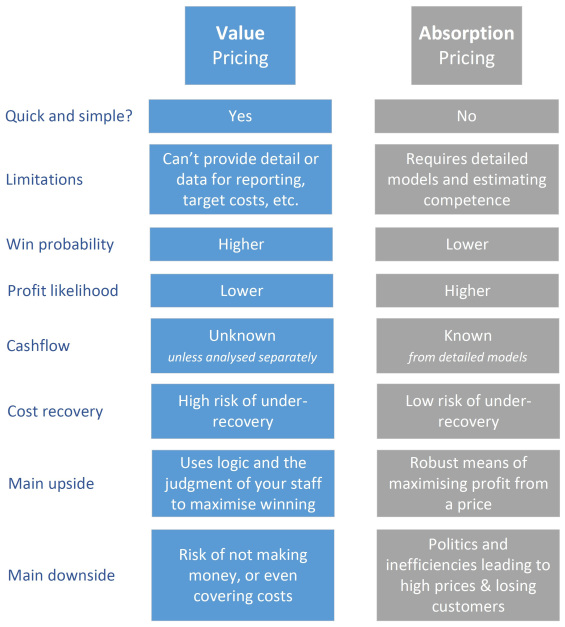

There are a variety of upsides and downsides to adopting value or absorption pricing:

If a company is small with a low cost-base that is easy to comprehend and manage then value pricing is all that is needed and, indeed, recommended. That said, cash flow should always be considered in parallel.

If a company is larger or has a cost-base that is complex and needs active management then absorption pricing is the sensible approach – provided costs and prices are moderated and scrutinised before being issued to customers.

Value Pricing – in more detail

Value pricing is named on the basis of the value perceived by the customer. We have all been customers and have our own perception of value, therefore the price we are prepared to pay before we’re told what it is – for a product or professional service. If we regularly go to the cinema, we ‘value’ it at £7.50 – £12 a ticket. If we go to a very nice and posh cinema we may increase that value perception to £20. If we went to a brand new cinema and they asked for £475 per ticket – would we accept it, graciously? Maybe we would if we had money to spare and it happened to be the world’s first fully immersive 4D experience. Realistically, we won’t accept such a high price – we would simply leave, go to another cinema, tell our friends and family and never return.

The art with value pricing, therefore, is to understand the market and to set a price that is commensurate with the customer’s perception of value.

Value pricing is orchestrated for new products or services in one of two ways:

- From first principles; or

- Following a critical review of detailed (perhaps absorption) cost and price calculation

First principles are consumer analysis, market research, professional judgment, and historical trends of current similar products/services. Simply speaking with and asking your customer about their value-view is advisable. By analysing a number of opinions and data sources a logical value price can be set.

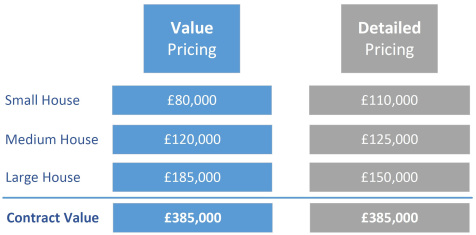

When a detailed cost and price has been calculated a value price can be adopted as an over-ride. In other words, a total price can be broken down into sub-components and sold at discrete value-prices, to make up the same overall total. As an example, imagine a customer wanting three houses to be built on the same site; one small, one medium and one large. The prices in order to recover costs may not align to a value-view, but can be over-ridden to align and secure the work:

The detailed cost and price is such that there isn’t much difference between small, medium and large as the marginal costs between each is small. However, a value-view would have a much greater difference between the sizes.

If the detailed cost and price approach were to be put forward then the customer would not accept the offer and go elsewhere. This is because the small house would be seen as too expensive. If, however, the value-presentation were put forward then the work would be awarded. The contract values are the same either way. The downside here is that cash flow may be negative for a period and therefore you would hold an additional cost of capital for a duration. This could be added to the price, however.

Client budgets can be problematic in that although the customer may agree that the value of a product or service is above the available budget they simply can’t afford what is on offer. In these scenarios, companies need to think hard about whether they will continue to try to sell to the customer or innovate to supply something of lesser value at a lower cost, provided the customer’s requirements are still met.

If Value pricing is to be adopted and it is expected to lead to low or insufficient levels of cost recovery then a business decision needs to be made as to how the company can lower costs to deliver and make money.

Absorption Pricing – in more detail

Absorption pricing is found more in large organisations bidding for high cost /high-risk work and to tight contractual rules such as firm fixed price (a price that is quoted and does not change for long periods of time, sometimes ten years or more) and engineering & construction contracts such as NEC3 Options A to E.

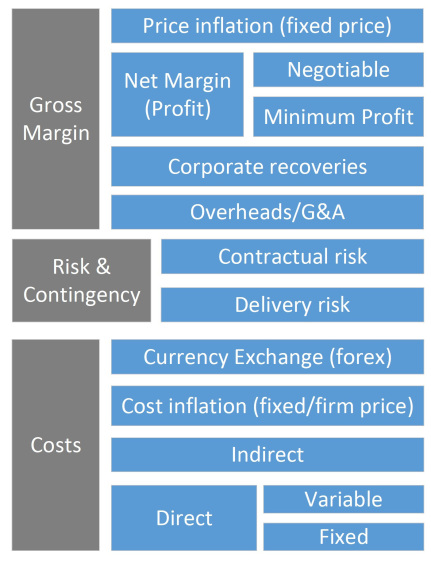

Subject to whether the customer takes the risk of cost inflation, foreign exchange or delivery risk and what binding contracts may say about punitive charges for late or sub-quality delivery (eg: liquidated damages, service credits, bonds/bank guarantees, etc.) an absorption price model will consist of some or all of the items shown below:

A price is modelled / calculated to absorb all the various elements of cost, risk, and gross margin and is a function of how accurate each component part has been monetised. Each component will be influenced by the quality level of the underlying solution (product, service or project plan) and will change as the solution changes. For absorption pricing professional services, there is an additional consideration termed ‘utilisation‘ – this is an adjustment to account for how much a fee-earning “billable” member of staff could bill to a customer on a time basis versus how much time they actually spend as a cost to the supplier: for example if a member of staff costs the company £100 per day and spends a full 5 day week working for a customer but can only bill 3 days per week then the daily price to the customer would need to recover £100 x 5 / 3 = £167 per day, not £100 per day.

Absorption pricing can descend into a catch-all of as much cost and contingency as can be thought of. Whilst absorption pricing is good at alleviating fears of not making money, giving certainty that risks have sufficient contingency set aside and giving hope of yielding bumper profits, it is weak in that it can form and reinforce prices to be far too high, resulting in losing work. It can also become an entrenched way to over-price again and again if left unchecked; the assumption being that the customer is the silly one and in fact, it is their loss. Preparing models early and analysing them against the Win Price – seeking to lower content to get to or below the Win Price – will mitigate this.

Which to choose?

Both. By undertaking value and absorption pricing in parallel, you can understand how your price is likely to be received by the customer, a ‘dry run’ if you like. You can also comprehend by how much your absorption calculations need to come down by so that the resultant price is the same (or better than) the value price.

Doing both can be hampered by the amount of time available. It is not likely that there will be enough time to look at both a value and an absorption pricing approach. That said, the best idea is to look at both and work to get them to reconcile. A method to do this is to articulate the value price across the “building-blocks” (content) of an absorption price and then track how the detailed absorption price matches each block via gap analysis. Any major differences can be addressed on a case-by-case basis.

For more expert advice and useful information for bid and proposal professionals, take a look at our Bid Hub.

Read more News